Top 5 ETF to Watch in 2024: A Comprehensive Guide

Investing in Exchange-Traded Funds (ETFs) can be a strategic way to diversify your portfolio, minimize risk, and potentially maximize returns. With 2024 offering new economic dynamics and market opportunities, identifying the right ETFs to invest in is crucial. This blog provides an in-depth analysis of the top 5 ETFs to consider for your investment strategy this year.

1. Vanguard Total Stock Market ETF (VTI)

Overview:

The Vanguard Total Stock Market ETF (VTI) is a comprehensive ETF that gives investors exposure to the entire U.S. stock market. It tracks the CRSP US Total Market Index, covering large-, mid-, small-, and micro-cap stocks.

Key Features:

- Expense Ratio: 0.03%

- Dividend Yield: Approximately 1.3%

- Assets Under Management (AUM): Over $1 trillion

- Performance: Historically, VTI has provided robust returns, mirroring the growth of the U.S. economy across different sectors.

Why Invest:

VTI is an excellent choice for investors seeking broad exposure to the U.S. equity market. Its low expense ratio means that more of your investment is working for you rather than going toward fees. The ETF’s diversification across sectors and market caps helps to mitigate risk, making it a cornerstone holding for any long-term investment portfolio.

In-Depth Analysis:

VTI’s inclusion of a wide array of stocks—from technology giants like Apple and Microsoft to smaller companies in various industries—ensures that investors can benefit from the broad growth of the U.S. economy. This ETF is especially advantageous during times of economic expansion when multiple sectors are likely to perform well.

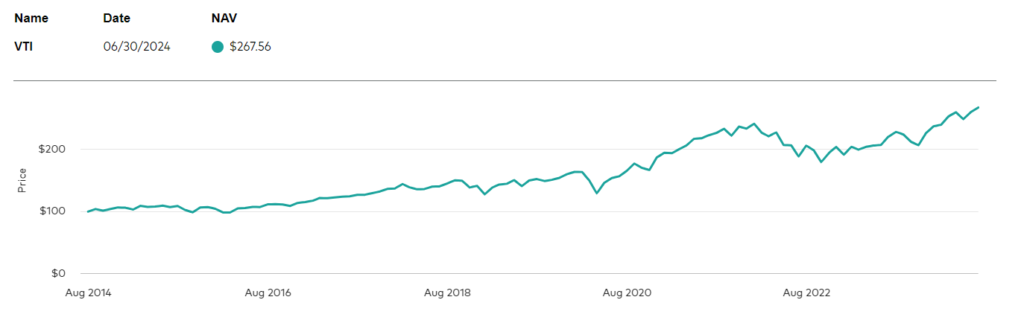

Market Growth:

Conclusion:

The Vanguard Total Stock Market ETF (VTI) has demonstrated impressive historical growth since its inception in 2001. Designed to provide broad exposure to the entire U.S. stock market, VTI tracks the CRSP US Total Market Index, encompassing large-, mid-, small-, and micro-cap stocks. This broad diversification has been a key factor in its steady performance.

From its launch, VTI has capitalized on the growth of the U.S. economy, reflecting the overall market’s upward trajectory. Its performance closely mirrors that of the total market index, delivering annualized returns of around 8-10% over the long term. This growth has been driven by strong performances in various sectors, notably technology, healthcare, and consumer discretionary, which make up significant portions of its holdings.

VTI’s appeal is further enhanced by its low expense ratio, currently at 0.03%, which ensures that more investor capital is allocated to the market rather than fees. This cost efficiency, combined with its comprehensive market coverage, has made VTI a popular choice among both individual and institutional investors.

Over the years, VTI has grown significantly in assets under management, now exceeding $1 trillion, cementing its position as a cornerstone in many diversified investment portfolios. Its historical growth underscores its effectiveness as a long-term investment vehicle.

2. iShares MSCI Emerging Markets ETF (EEM)

Overview:

The iShares MSCI Emerging Markets ETF (EEM) offers exposure to a diverse range of companies in emerging markets. It tracks the MSCI Emerging Markets Index, which includes large- and mid-cap stocks across 26 emerging economies.

Key Features:

- Expense Ratio: 0.68%

- Dividend Yield: Approximately 1.6%

- AUM: Over $30 billion

- Performance: While more volatile than developed markets, EEM has the potential for higher growth due to the economic expansion in emerging markets.

Why Invest:

EEM is ideal for investors looking to diversify their portfolios internationally and tap into the growth potential of emerging markets. These markets are often characterized by higher economic growth rates compared to developed economies, driven by factors like industrialization, urbanization, and increasing consumer spending.

In-Depth Analysis:

Investing in EEM provides exposure to rapidly growing economies such as China, India, and Brazil. Despite the higher risk associated with emerging markets, the potential for significant returns is substantial. As these countries continue to develop their infrastructure and consumer markets, companies within these regions can see accelerated growth, benefiting investors.

Market Growth:

Conclusion:

The iShares MSCI Emerging Markets ETF (EEM), launched in 2003, provides investors with access to a diversified portfolio of large- and mid-cap stocks in emerging markets. Its historical growth has been characterized by higher volatility compared to developed markets, reflecting the dynamic and often unpredictable nature of emerging economies.

Since its inception, EEM has aimed to capture the economic expansion and development in regions such as Asia, Latin America, Eastern Europe, and Africa. The ETF tracks the MSCI Emerging Markets Index, which includes prominent companies from countries like China, India, Brazil, and South Korea. Over the years, these countries have experienced significant industrialization, urbanization, and rising consumer demand, contributing to the ETF’s growth.

While EEM’s returns have been more variable, with periods of rapid growth followed by corrections, its long-term performance has generally been positive. The ETF has benefited from the rise of major corporations in the tech, finance, and consumer sectors within these developing markets. However, geopolitical risks, currency fluctuations, and economic instability have also impacted its performance.

Despite these challenges, EEM has grown in assets under management, reaching over $30 billion. It remains a popular choice for investors seeking to diversify their portfolios with exposure to high-growth potential markets outside the developed world.

3. Invesco QQQ Trust (QQQ)

Overview:

The Invesco QQQ Trust (QQQ) is an ETF that tracks the Nasdaq-100 Index, which comprises 100 of the largest non-financial companies listed on the Nasdaq Stock Market.

Key Features:

- Expense Ratio: 0.20%

- Dividend Yield: Approximately 0.5%

- AUM: Over $200 billion

- Performance: Known for its strong historical performance, particularly driven by the technology sector.

Why Invest:

QQQ is a great choice for investors looking to gain exposure to the technology sector and other high-growth industries. The Nasdaq-100 includes some of the most innovative and high-performing companies in the world, such as Apple, Amazon, and Alphabet.

In-Depth Analysis:

Technology continues to be a driving force in global economic growth. Investing in QQQ allows investors to benefit from advancements in areas like artificial intelligence, cloud computing, and e-commerce. While tech stocks can be more volatile, the long-term growth prospects make QQQ a compelling investment.

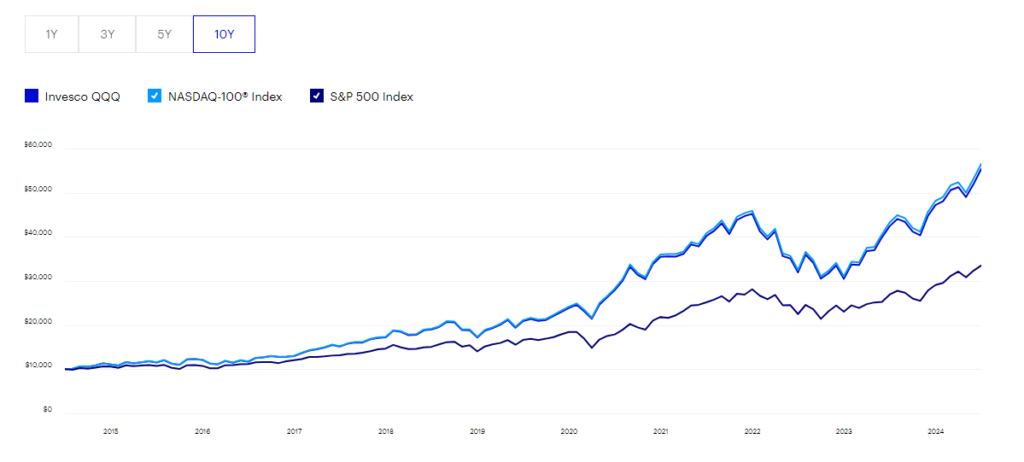

Market Growth:

Conclusion:

The Invesco QQQ Trust (QQQ), commonly referred to as the QQQ ETF, tracks the performance of the Nasdaq-100 Index, which comprises 100 of the largest non-financial companies listed on the Nasdaq Stock Market. Since its inception in 1999, QQQ has been synonymous with growth and innovation, focusing primarily on the technology sector.

QQQ’s historical growth has been remarkable, driven by the exponential rise of companies like Apple, Microsoft, Amazon, and Alphabet (Google). These tech giants are at the forefront of innovation in areas such as cloud computing, e-commerce, digital entertainment, and artificial intelligence. As these companies have thrived, so has QQQ, attracting investors seeking exposure to high-growth sectors.

The ETF’s performance has consistently outpaced broader market indices like the S&P 500, reflecting the Nasdaq-100’s heavy weighting towards technology and growth stocks. Despite occasional periods of volatility, QQQ has delivered strong long-term returns, making it a favorite among investors betting on the future of technology and innovation.

With assets under management exceeding $200 billion, QQQ continues to grow in popularity and influence within the ETF landscape, offering investors a strategic way to participate in the ongoing evolution of the global technology sector.

4. SPDR S&P 500 ETF Trust (SPY)

Overview:

The SPDR S&P 500 ETF Trust (SPY) is one of the most well-known and widely-traded ETFs. It aims to mirror the performance of the S&P 500 Index, which includes 500 of the largest U.S. companies.

Key Features:

- Expense Ratio: 0.09%

- Dividend Yield: Approximately 1.5%

- AUM: Over $400 billion

- Performance: Historically consistent with the overall U.S. stock market performance.

Why Invest:

SPY offers a straightforward way to invest in the U.S. stock market, representing a diverse range of industries. It’s an excellent option for those seeking steady growth and income through dividends from established companies.

In-Depth Analysis:

The S&P 500 Index is often used as a benchmark for the overall U.S. market. SPY’s diversified portfolio includes companies from sectors such as technology, healthcare, finance, and consumer goods. This diversification helps mitigate sector-specific risks and provides a balanced approach to equity investing.

Market Growth:

Conclusion:

The SPDR S&P 500 ETF Trust (SPY) has a storied history dating back to its inception in 1993, making it one of the oldest and largest ETFs in the world. SPY seeks to mirror the performance of the S&P 500 Index, which consists of 500 of the largest publicly traded companies in the United States, spanning various sectors including technology, healthcare, financials, and consumer goods.

SPY’s historical growth is closely tied to the overall performance of the U.S. stock market. It has provided investors with a straightforward way to gain exposure to the largest and most established companies in the country. The ETF’s diversified portfolio reduces individual stock risk while capturing the growth potential of the broader economy.

Over the years, SPY has consistently delivered competitive returns, often used as a benchmark for the overall market’s performance. Its low expense ratio of 0.09% ensures cost-effective access to a diversified basket of blue-chip stocks. With assets under management surpassing $400 billion, SPY remains a cornerstone investment for institutions and individual investors alike, reflecting its reliability and long-term appeal in navigating the ups and downs of the U.S. equity market.

5. ARK Innovation ETF (ARKK)

Overview:

The ARK Innovation ETF (ARKK) focuses on disruptive innovation, investing in companies that are expected to benefit from advancements in technology, scientific research, and industrial innovation.

Key Features:

- Expense Ratio: 0.75%

- Dividend Yield: N/A (focused on growth rather than income)

- AUM: Approximately $17 billion

- Performance: Known for its high volatility but substantial potential for outsized returns.

Why Invest:

ARKK is suited for investors with a higher risk tolerance who are looking for exposure to cutting-edge technologies and innovative companies. The ETF includes stocks from sectors like genomics, autonomous technology, and next-generation internet.

In-Depth Analysis:

ARKK’s portfolio is actively managed and focuses on companies poised to change the world. This includes Tesla, Roku, and Zoom Video Communications. The ETF’s approach to investing in disruptive innovation can lead to significant growth, but it also comes with increased volatility. Investors should be prepared for larger price swings and should consider ARKK as a long-term investment.

Conclusion:

The ARK Innovation ETF (ARKK) is renowned for its focus on disruptive innovation, investing in companies at the forefront of technological advancements and societal shifts. Launched in 2014 by ARK Invest, ARKK has gained significant attention and popularity due to its high-risk, high-reward investment strategy.

ARKK’s historical growth is driven by its concentrated portfolio of innovative companies across sectors such as genomics, robotics, artificial intelligence, and fintech. This ETF actively seeks out companies poised to revolutionize their industries, often before they reach mainstream recognition.

Despite periods of volatility, ARKK has delivered impressive returns, reflecting the rapid growth and transformative potential of its holdings. Stocks like Tesla, Square, and CRISPR Therapeutics, among others, have propelled ARKK’s performance and solidified its reputation as a leader in thematic investing.

With assets under management reaching approximately $17 billion, ARKK continues to attract investors seeking exposure to cutting-edge technologies and disruptive innovations. Its active management approach and visionary investment strategy make ARKK a compelling option for those willing to embrace higher risk in pursuit of substantial long-term growth opportunities.

Market Growth:

Investing Tips

- Diversification: Don’t put all your money into one ETF. Spread your investments across different ETFs to mitigate risk.

- Research: Stay informed about the ETFs you’re investing in. Understand their holdings, sector focus, and performance history.

- Risk Tolerance: Know your risk tolerance. High-reward ETFs like ARKK can offer substantial returns but also come with higher volatility.

- Long-Term Focus: Investing in ETFs is generally more effective as a long-term strategy. Short-term market fluctuations can be smoothed out over time.

- Regular Review: Periodically review your portfolio to ensure it aligns with your investment goals and market conditions.

By carefully selecting and managing your ETF investments, you can build a diversified portfolio that meets your financial objectives for 2024 and beyond.

Conclusion

Each of these ETFs offers unique advantages and caters to different investment goals and risk tolerances. Here’s a quick recap:

- Vanguard Total Stock Market ETF (VTI) – Best for broad U.S. market exposure with low fees.

- iShares MSCI Emerging Markets ETF (EEM) – Ideal for international diversification and high growth potential.

- Invesco QQQ Trust (QQQ) – Perfect for those seeking exposure to the tech sector and innovative companies.

- SPDR S&P 500 ETF Trust (SPY) – A solid choice for consistent growth and income through dividends from large U.S. companies.

- ARK Innovation ETF (ARKK) – Suited for investors interested in high-growth, disruptive technologies and innovation.